Financial Success Plans & MoneyCoaches

Scaling personalized financial planning to 30,000 students

Duration

2017–2020

Role

Chief Creative Officer, NextThought

Design Team

Samuel Chinchilla, Michael McLaughlin, Madison Kay

Introduction

In 2017, The University of Oklahoma committed to providing financial planning support to every student. To do this, they established the MoneyCoach program—a team of financial experts focused on academics. But they had one problem, how does a small team scale to support 30,000 students in a way that makes each student feel like they have a personal connection with an advocate who cares about them? We met with the OU team and walked through every step of their process, end to end, to develop a plan to extend the reach of their skills and expertise with technology.

The stakes were high (with an annual cost of attendance of up to $35,000), and the subject matter was intimidating and anxiety-provoking. Students needed to create a plan, and they also needed to understand that plan and everything it involved. We created the Financial Success Plan to walk students through the process in an easy-to-understand and adaptable "conversation" that helped them identify their areas of need and the fund sources available. When appropriate, it would prompt students to schedule a meeting with a MoneyCoach. The resulting data was presented to coaches in the MoneyCoach administrative application. There, coaches could see which students they were meeting with each day, review their information, and document the results of each meeting. This system drastically reduced the time needed for each coaching session by offloading the repetitive tasks and conversations and also freed the coaches to cover specific topics and areas of concern that would best utilize their time and expertise.

Objectives

Create an automated experience that walks students and their families through complex financial topics that are stressful and anxiety-inducing. This experience needed to make people feel like they had an advocate who cared about them and would help them through the process. It also was important to celebrate success (financial windfalls like scholarships and grants) and be sensitive and authentic when the debts started stacking up. Financial planning is the most critical component of students' academic success—so the stakes were high on both sides. Some students have a small financial gap to cover and need little help, and the system would skip them past unnecessary topics. Others need to be walked through every step, sometimes more than once, before meeting with their MoneyCoach.

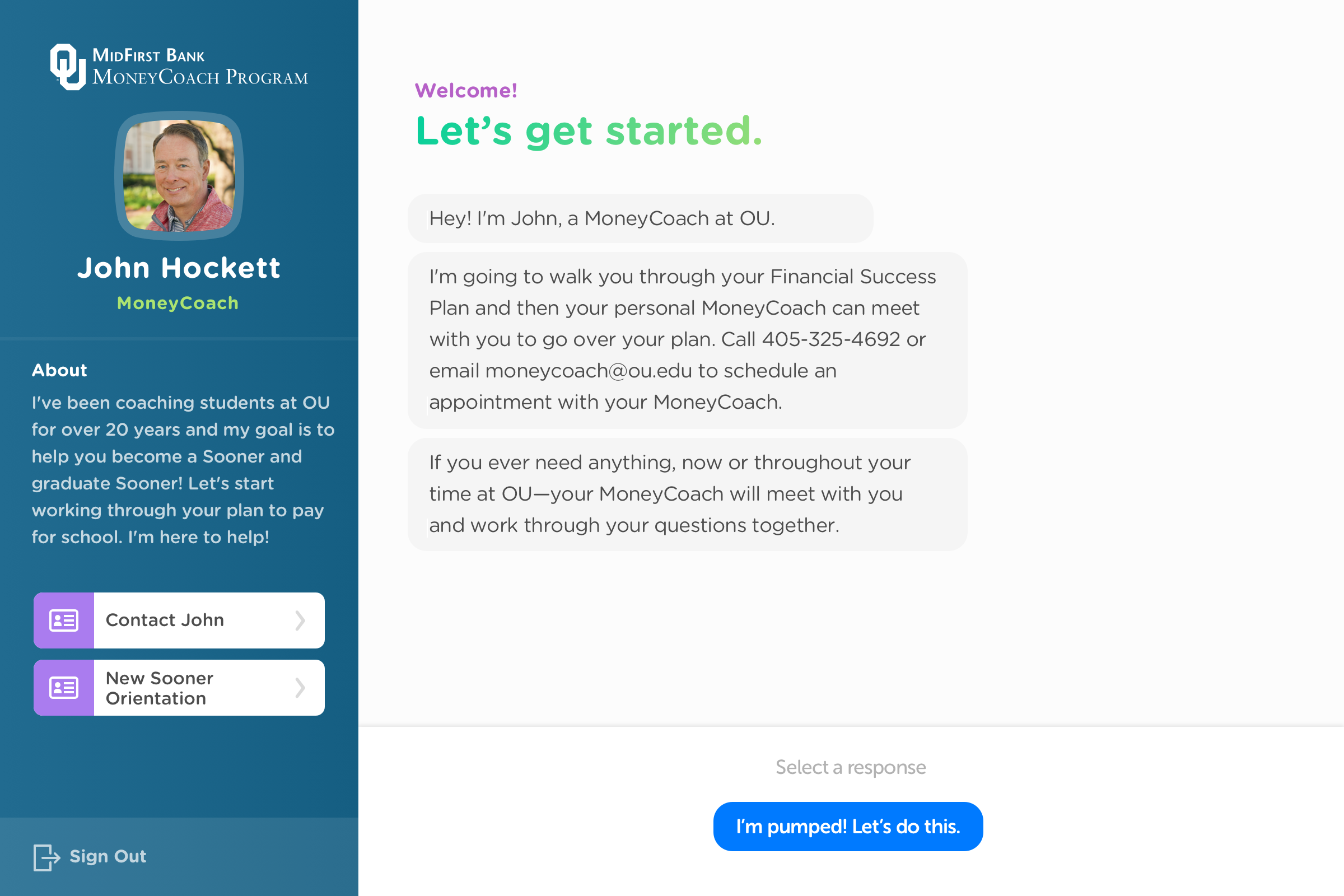

Welcome to the Financial Success Plan

We start off with a quick welcome from your MoneyCoach. The coach information is dynamic and reflects the actual person you'll be meeting with at a later date.

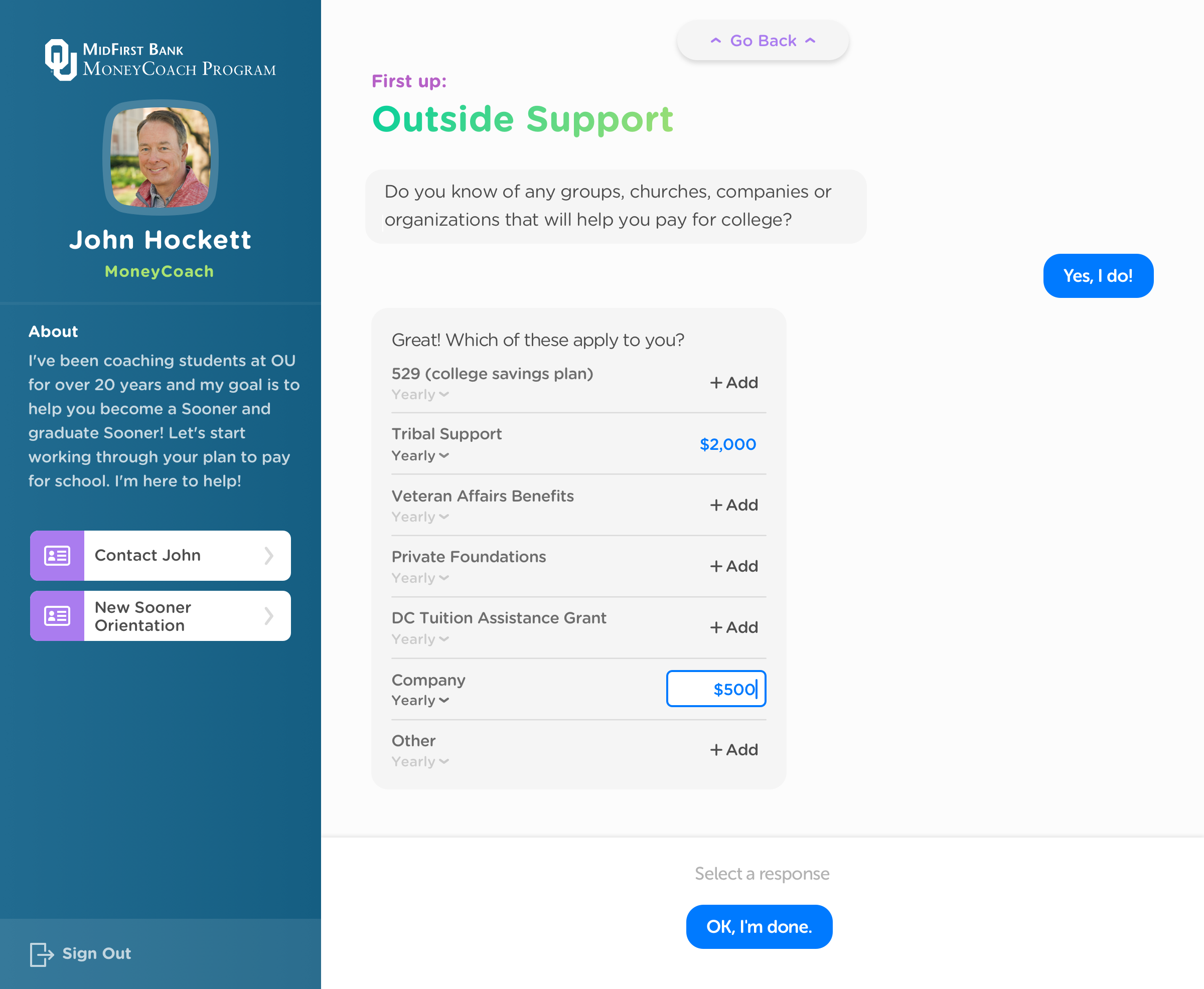

Identify Outside Fund Sources

Start with the easy topics first—if we get some early wins we may be able to skip the loan conversation.

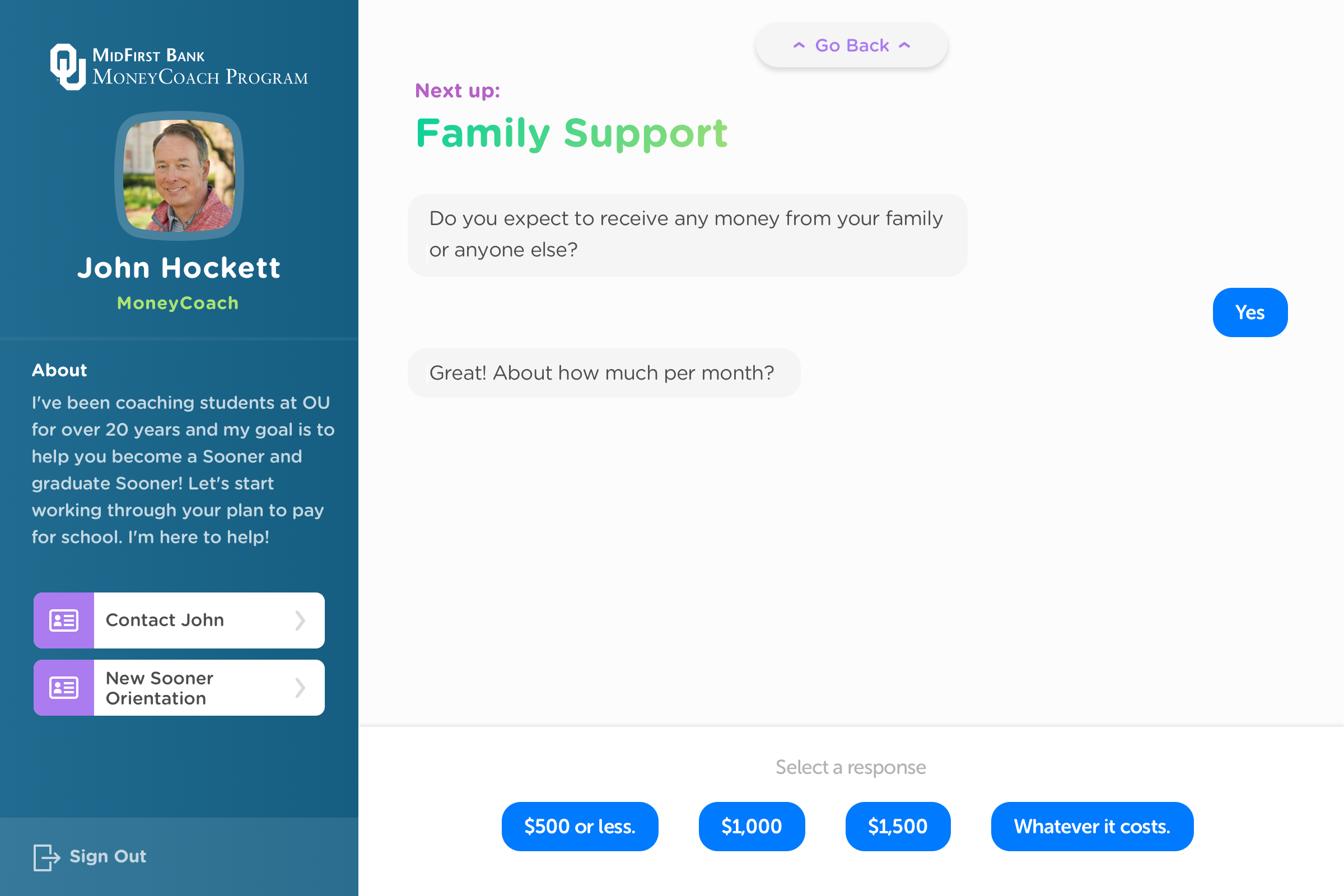

Family Support

Do they have family members or friends that intend to help out? People often have family assurances, but it's time to get specific about the monthly numbers. This prompt will help start the conversation.

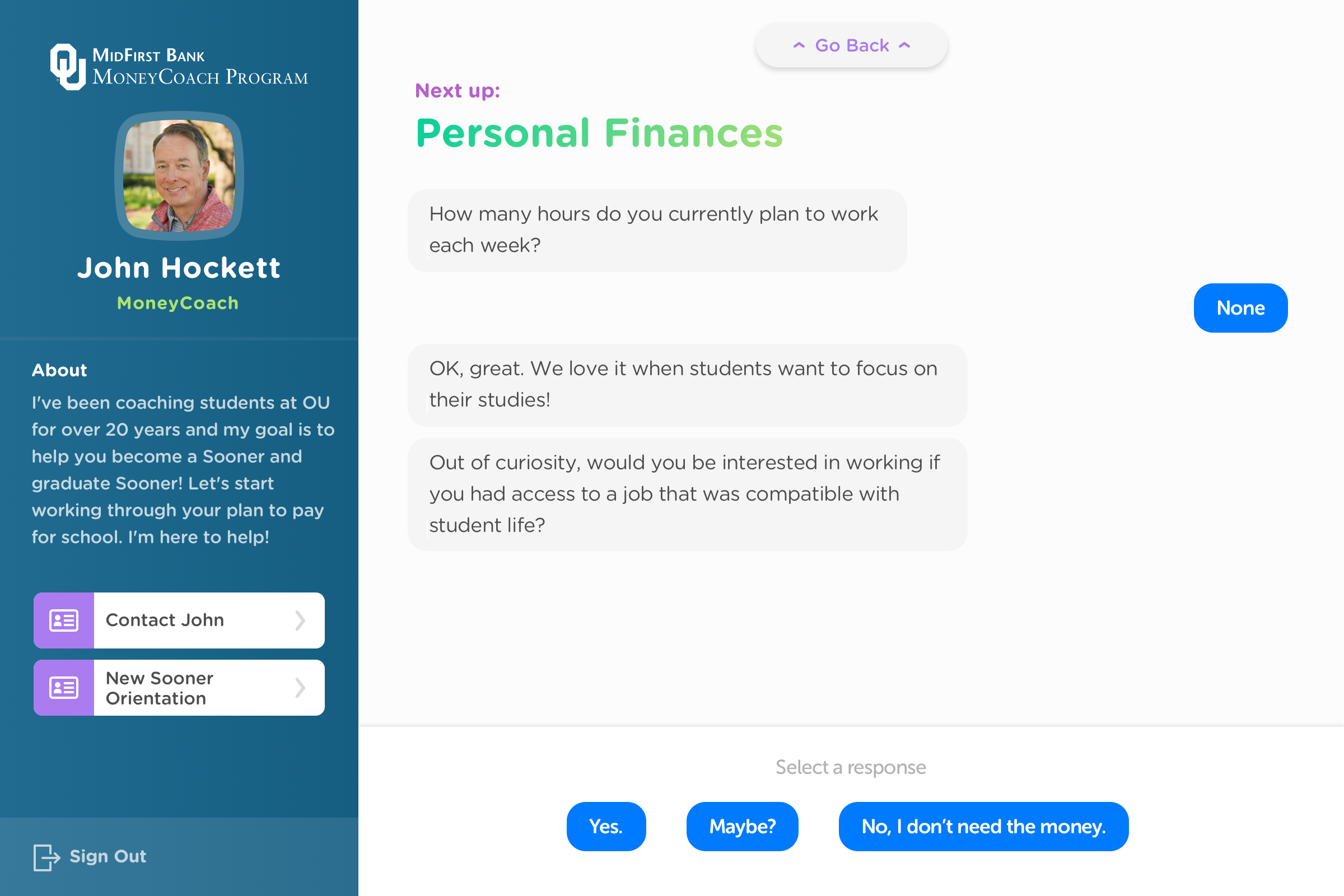

Will you be working?

Here's where students have direct control. How many hours do they want to work each week versus how many loans do they want to take on? Some time to process this before meeting with a MoneyCoach is very helpful.

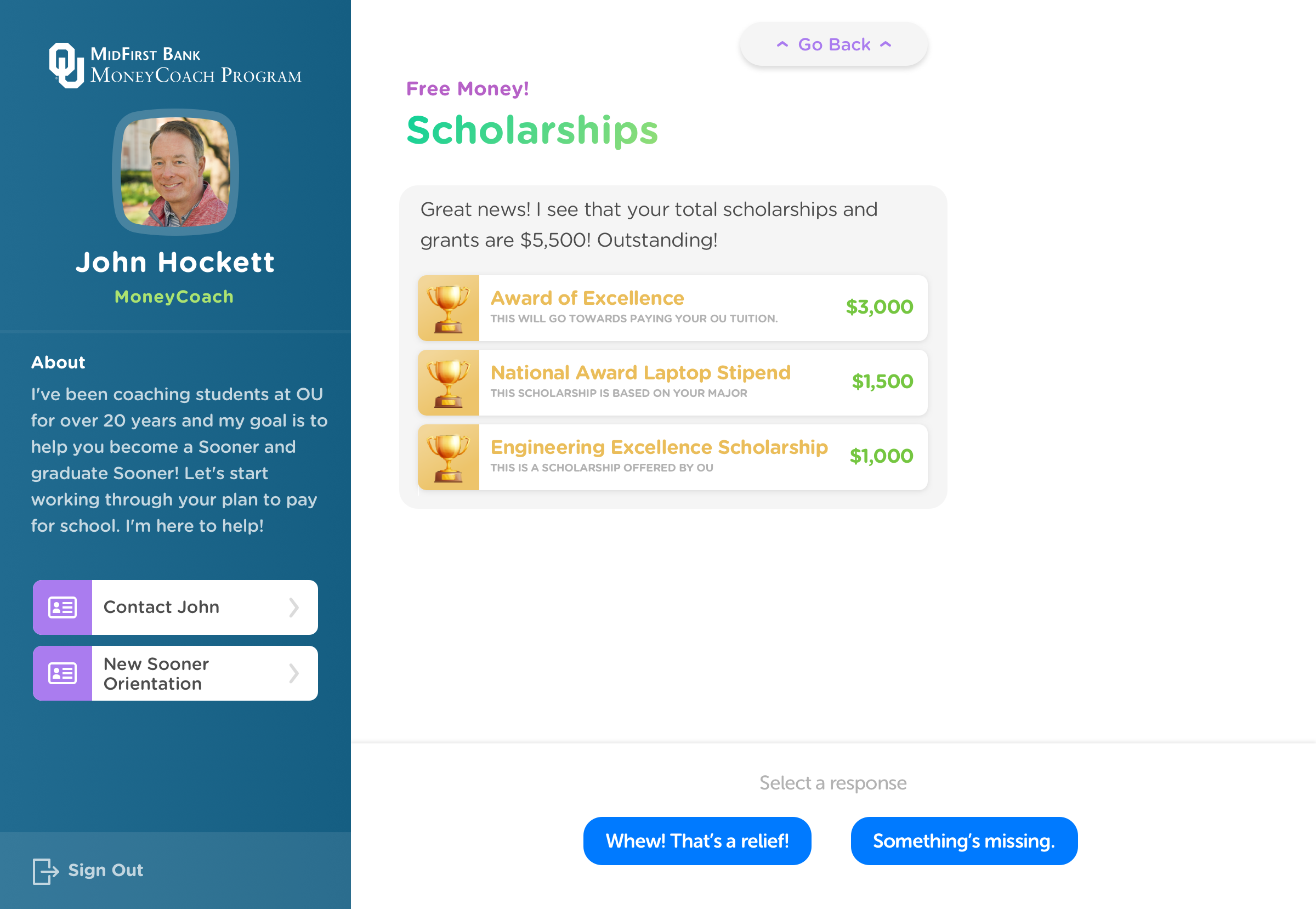

Let's celebrate free money!

This step doesn't happen for everyone, but when it does it's a welcome relief!

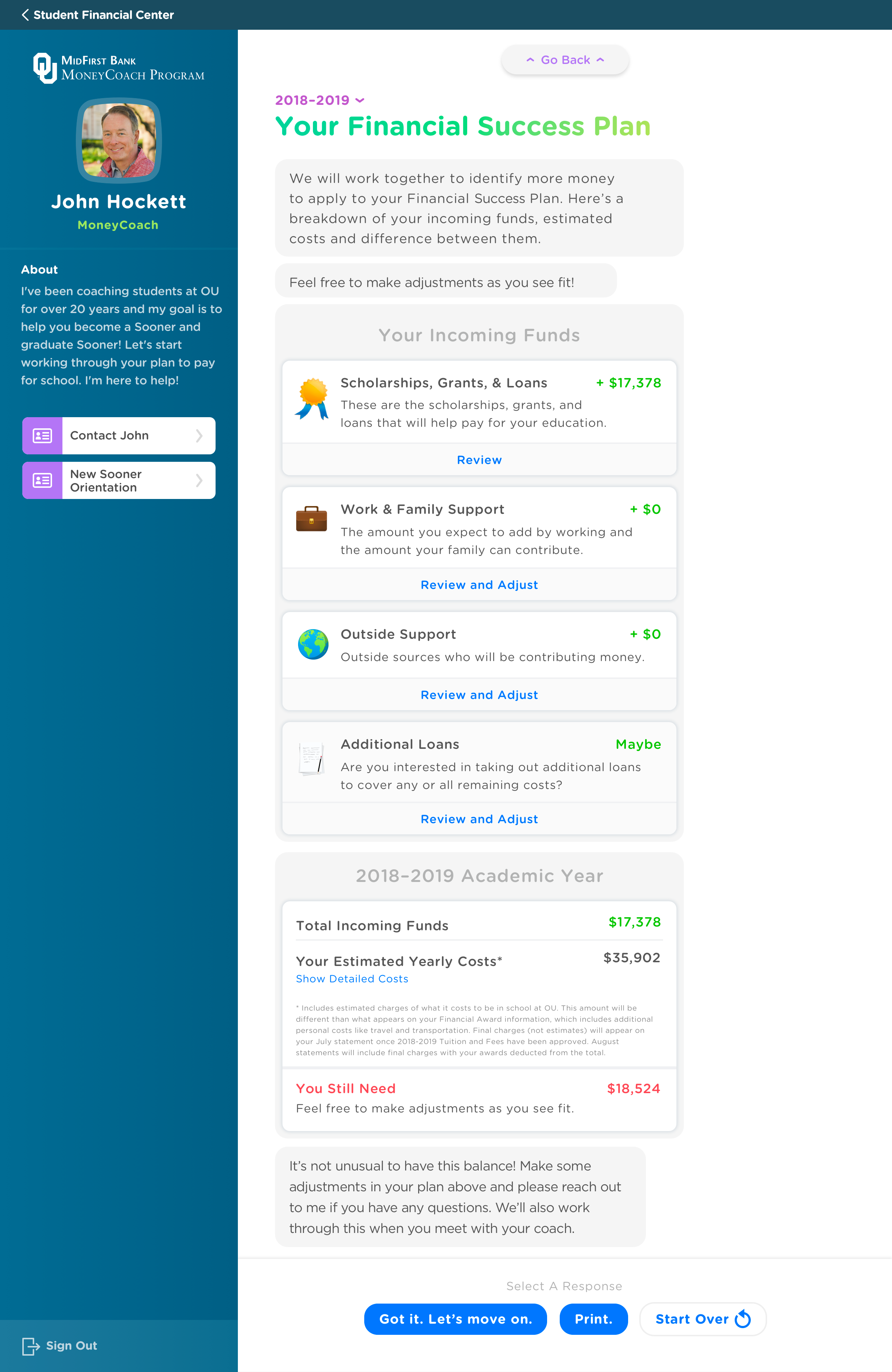

Review and Make Adjustments

Students can review their plan and make adjustments. There are also steps to learn more about loans, but the bulk of that conversation is best reserved for the in-person meeting with their MoneyCoach.

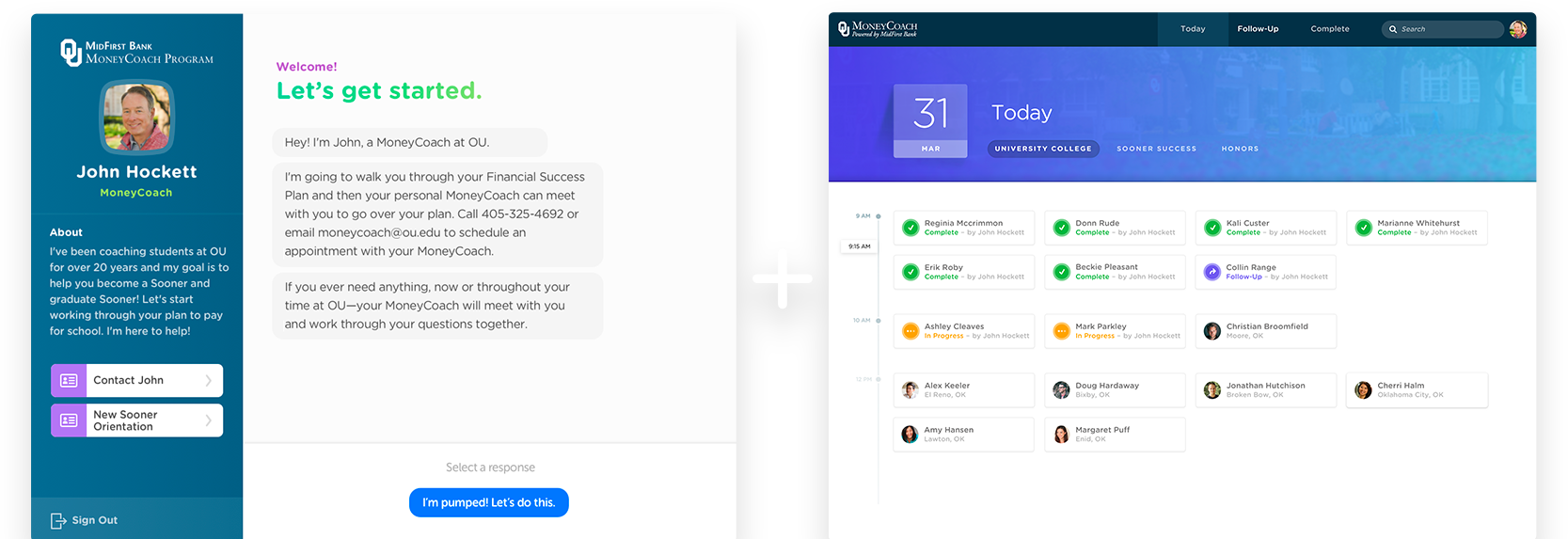

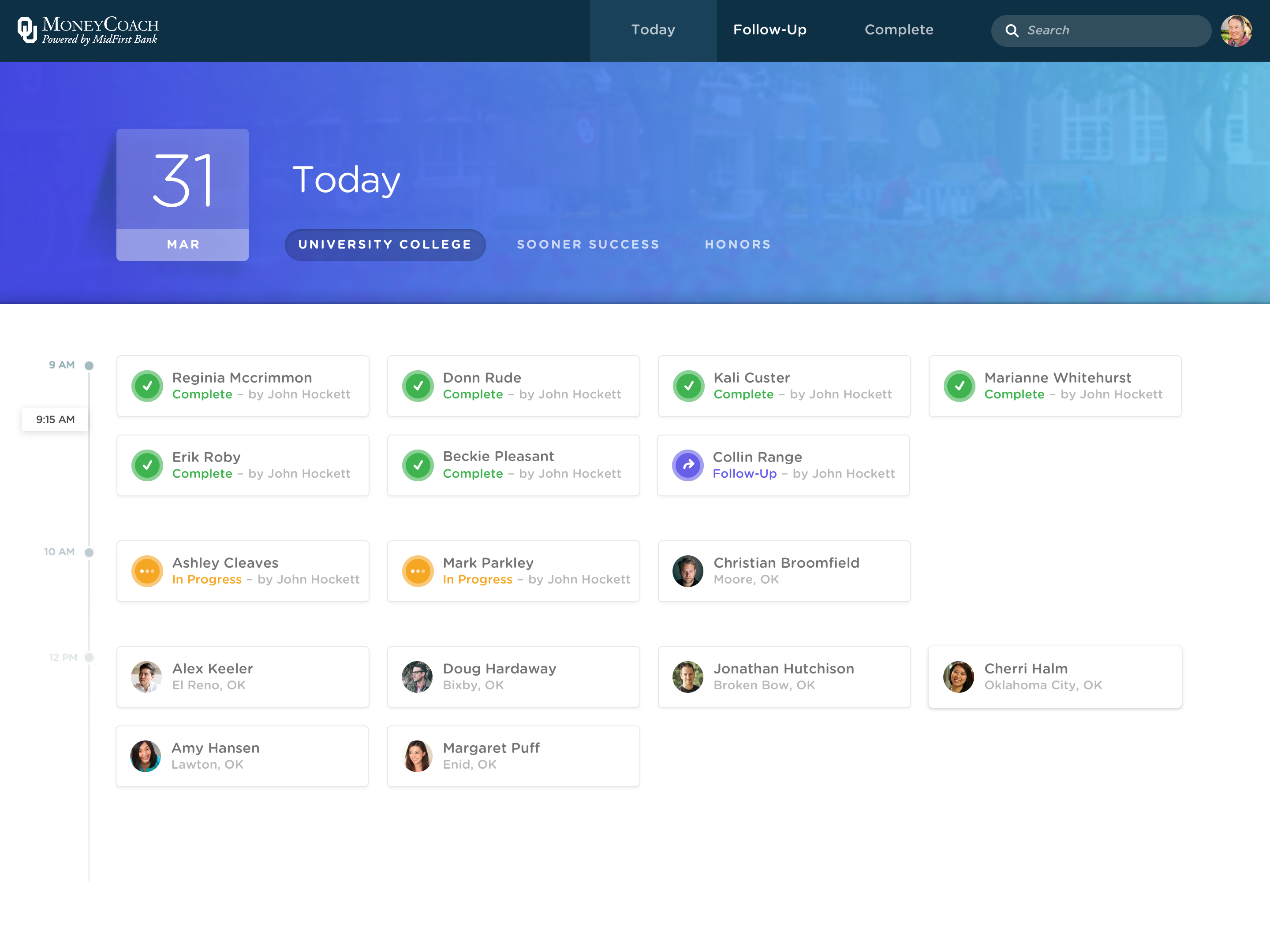

Today's MoneyCoach Sessions

This shows coaches their scheduled coaching sessions for the day.

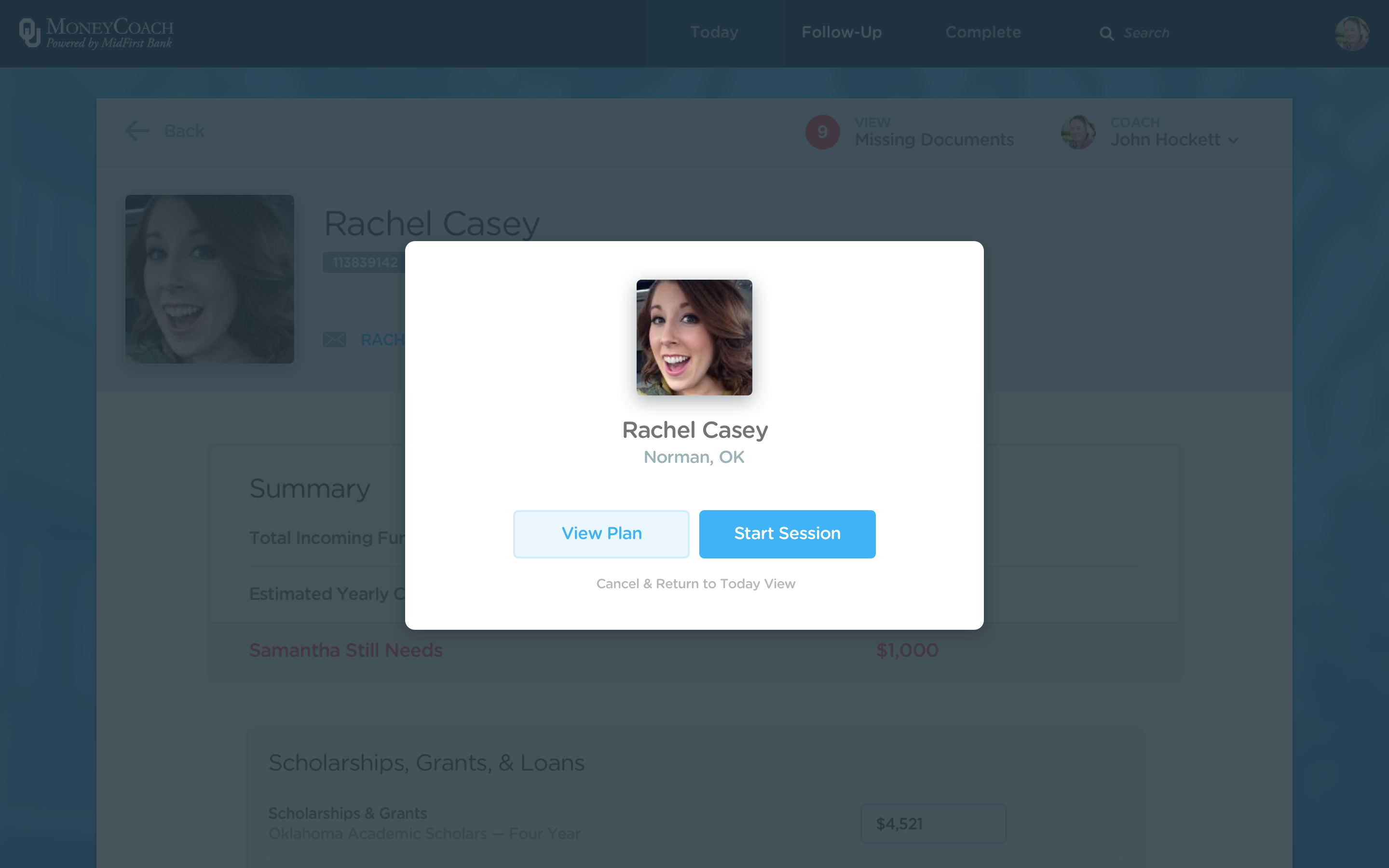

Start a Coaching Session

Coaches can review information in preparation, or start a coaching session if the student is present.

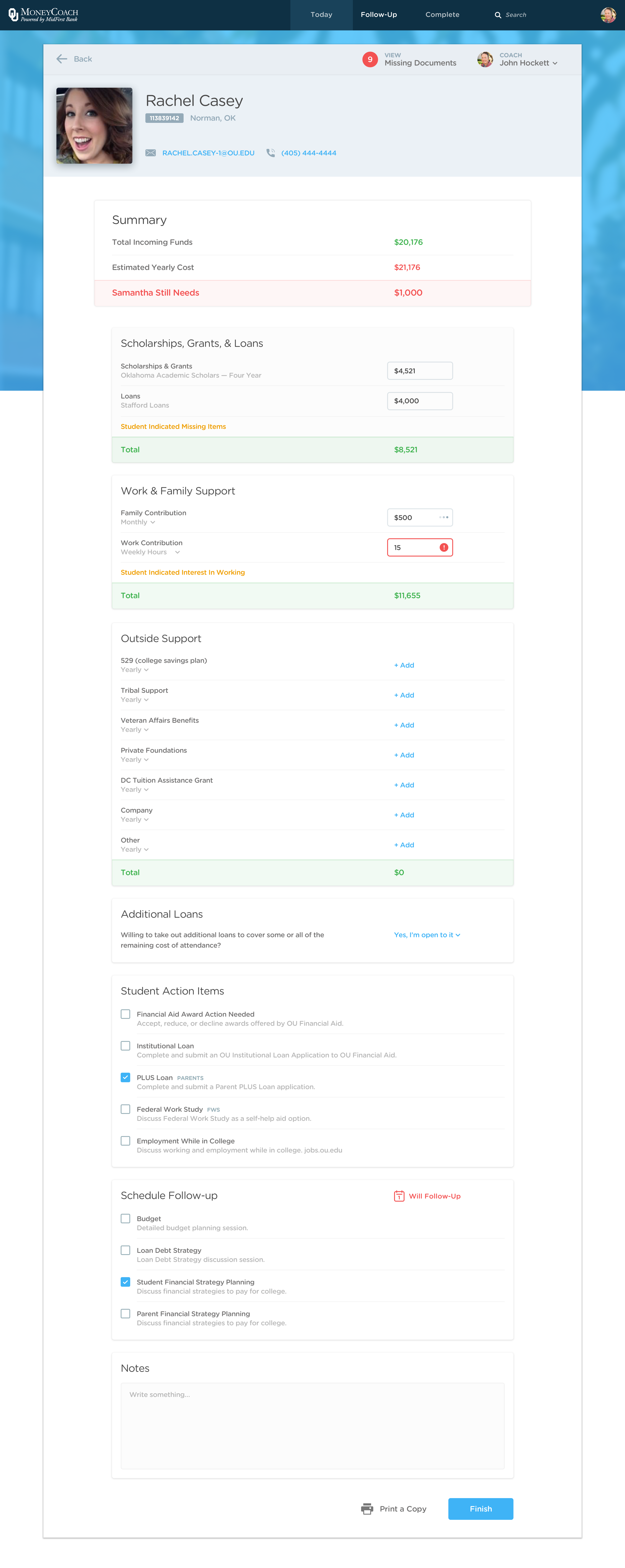

Review Plan, Set Action Items, and Follow-up

The MoneyCoach will review this page with the student. At the end of the session, the coach will mark action items and notes and provide a printed copy. Optionally scheduling a targeted follow-up session.

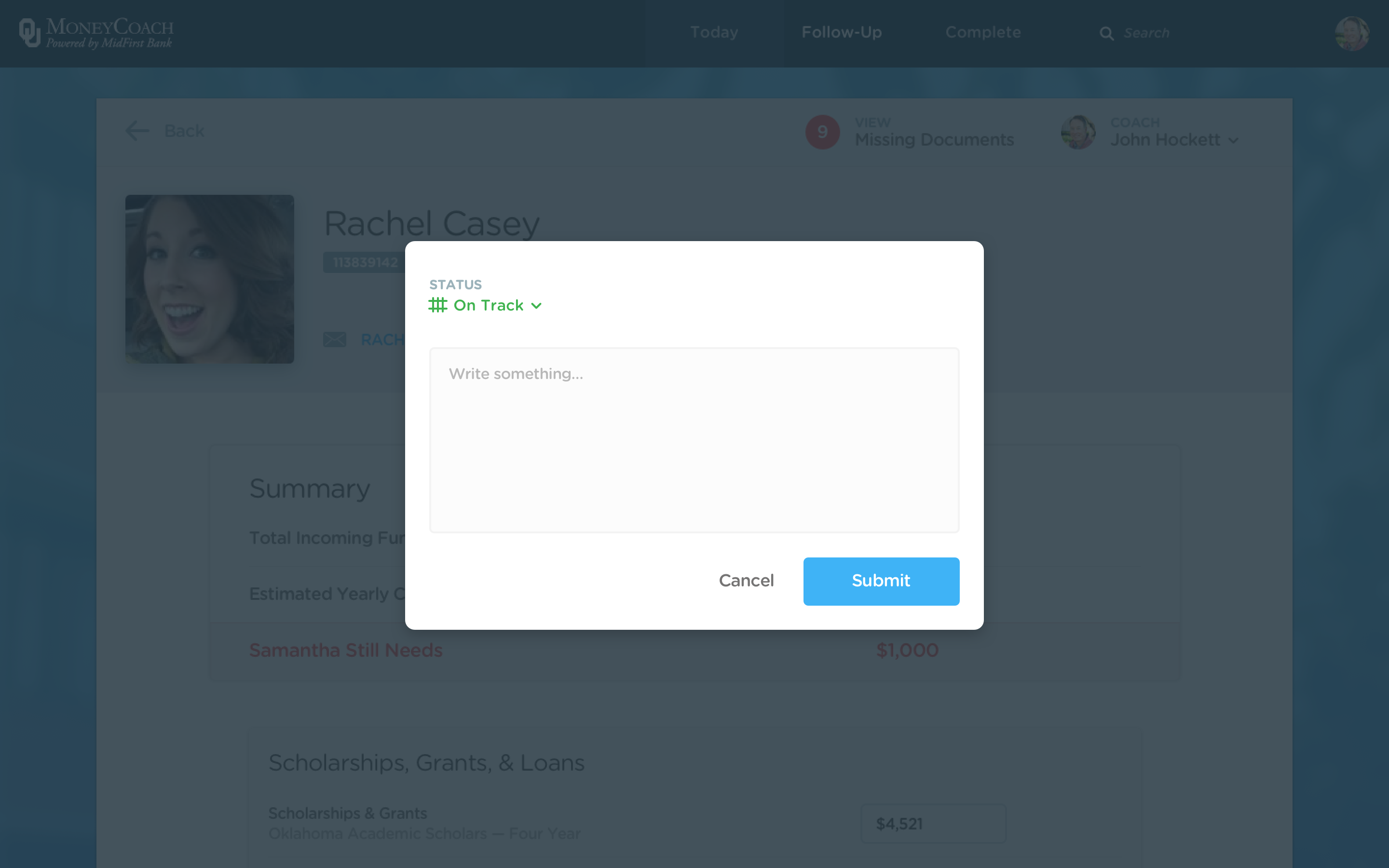

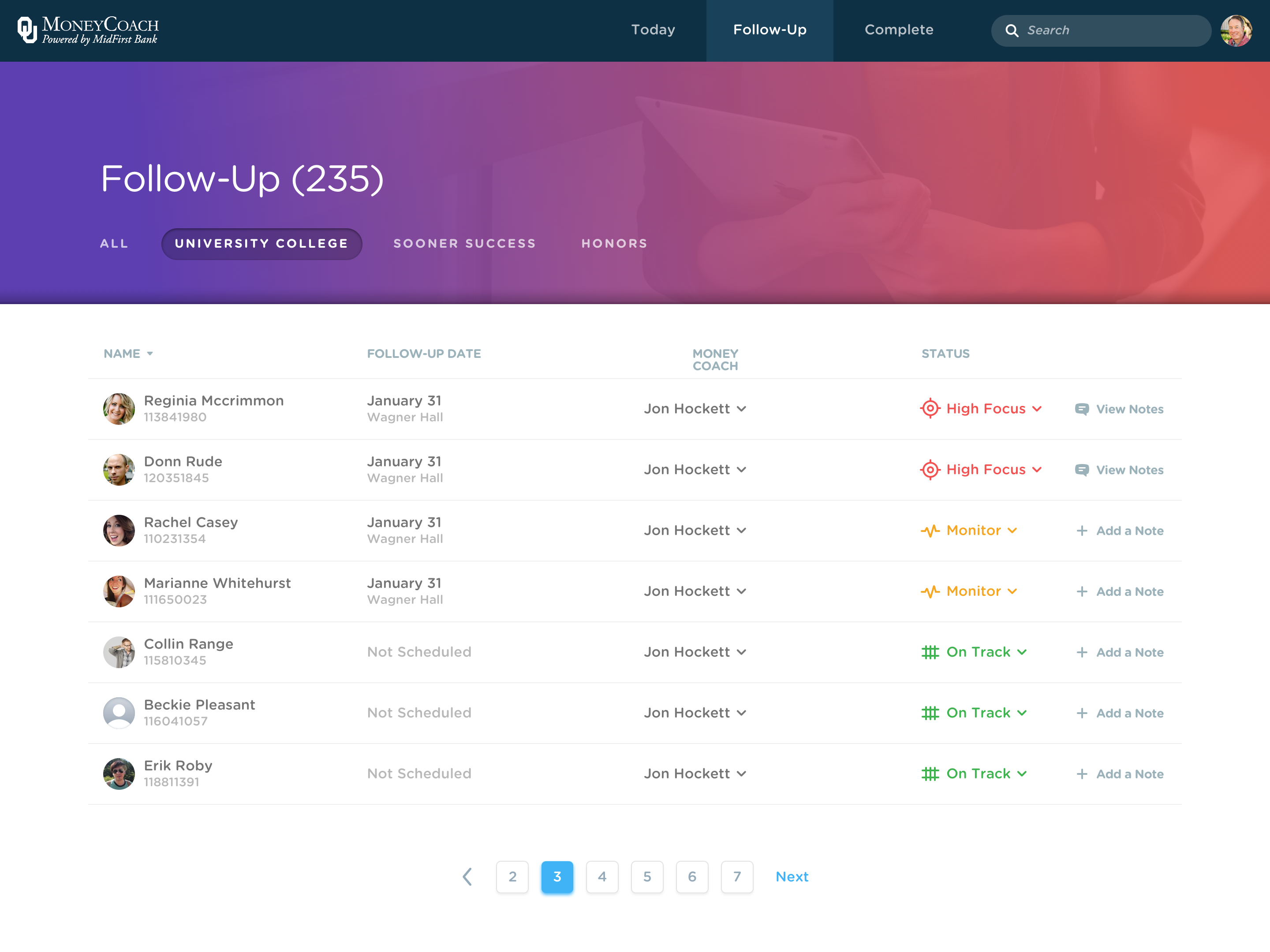

Session Remarks and Status

After the student leaves, the MoneyCoach has a place to document remarks and an assessment of the student's status: On Track, Monitor, or High Focus—meaning the student will need consistent follow-up from coaches).

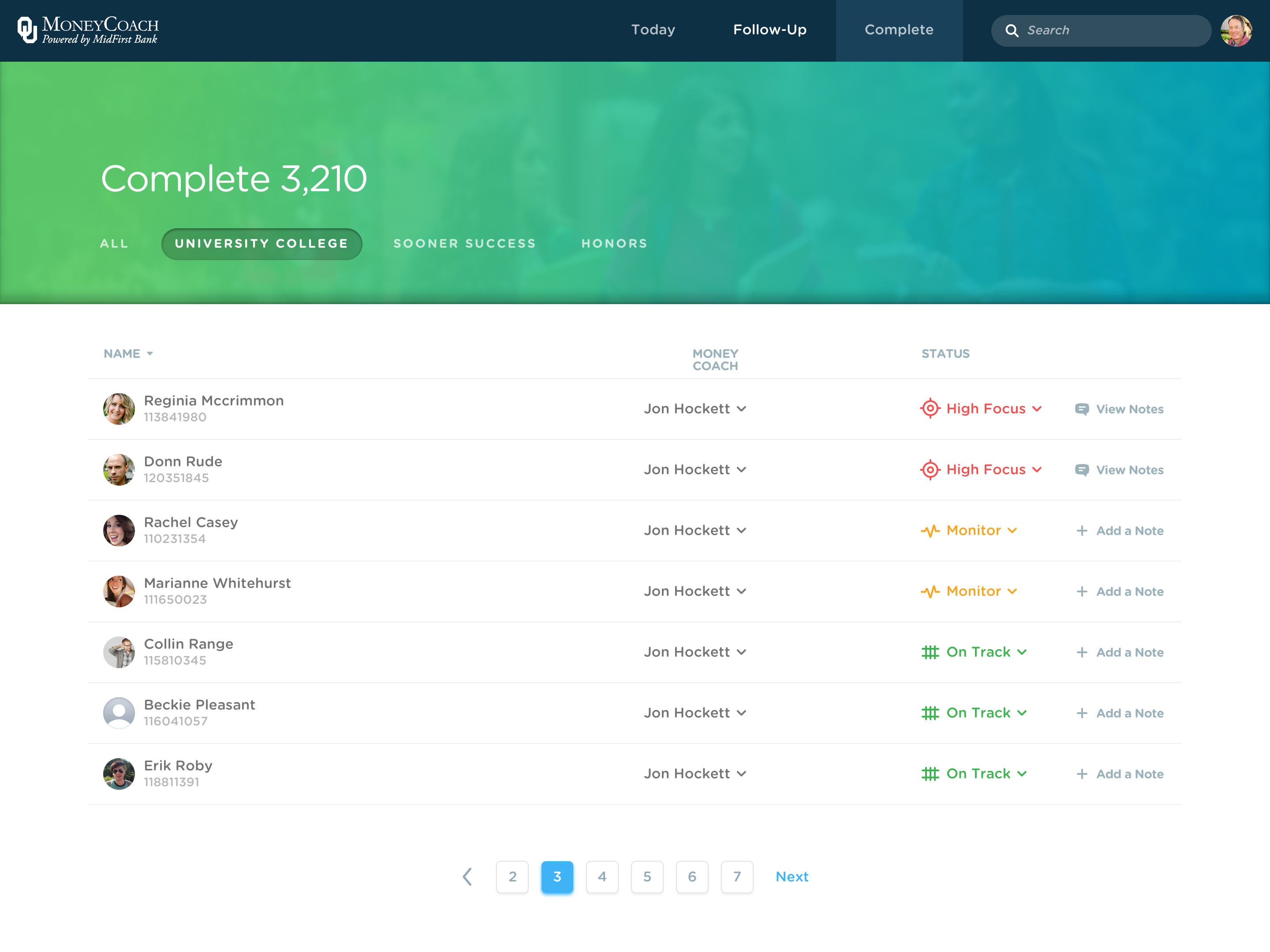

Review Completed Sessions

MoneyCoaches can review all completed coaching sessions, optionally filtered by location, coach, or status. Also sortable by name, coach, or status.

Follow-up Sessions

Review students marked for follow-up.

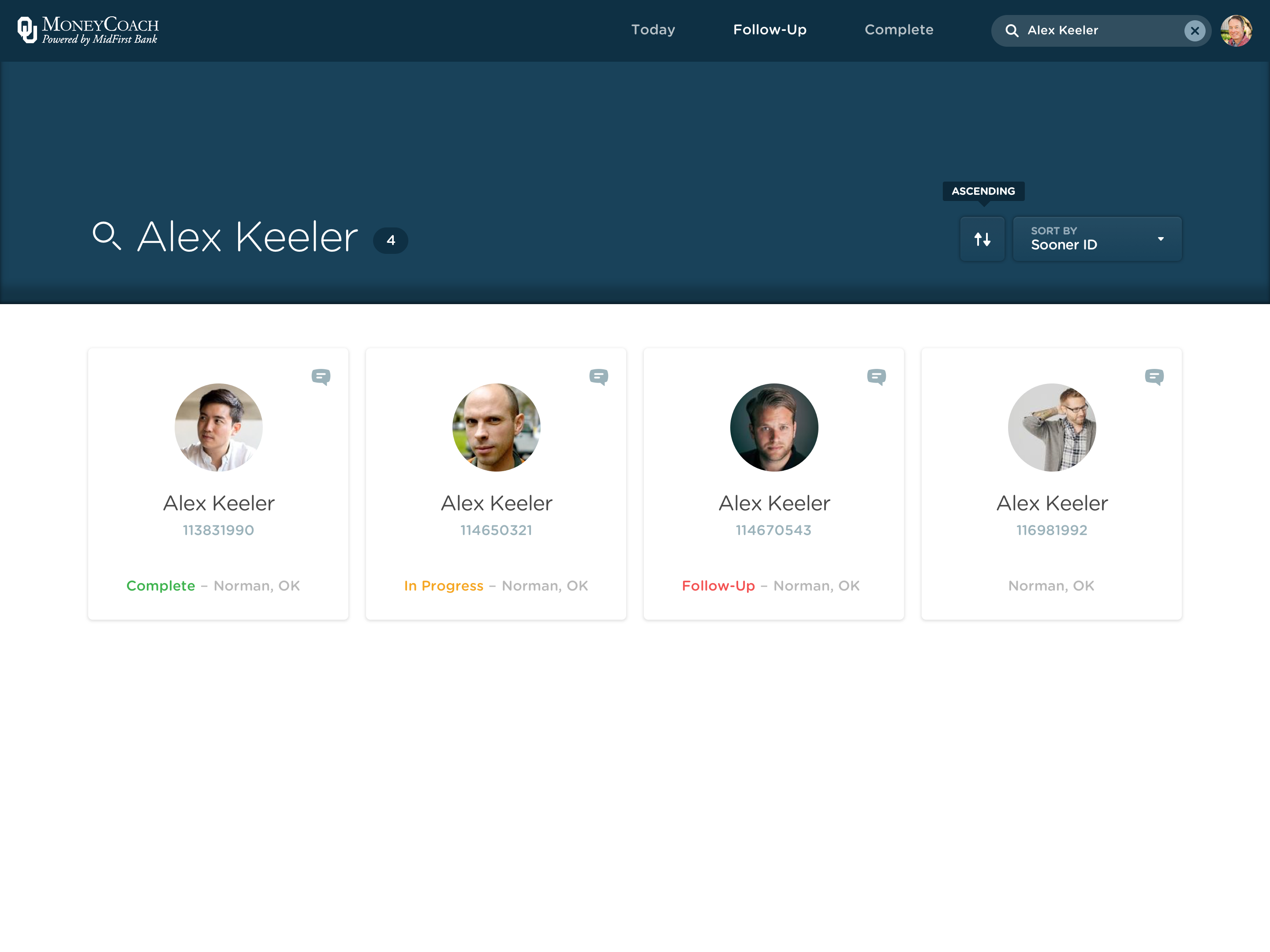

Search

Search for quick access to student records.

Results

The Financial Success Plan and MoneyCoach programs were hugely successful. Serving 30,000 students with detailed financial planning and tracking was a massive team effort that played a key role in helping the university reach unprecedented student retention and graduation numbers.

Work

NextThought Learning PlatformCheck it out

University Housing Contractsfeast your eyes

Student Financial Center & Award LetterLook it over

Scholarship GeniusScope it Out

Threat Response Drill (AR/VR—Password Required)Take a gander

Aaron Eskam

Product Design + Strategy

405 203 5720

aaron@eskam.com · LinkedIn · Resume